Introduction about GST

Launched on 1 July 2017, India’s Goods & Services Tax (GST) unified multiple indirect taxes—like VAT, service tax, excise, and entertainment tax—into a destination-based, value-added tax system. Originally comprising five broad rates (0%, 5%, 12%, 18%, 28%) plus cesses on select items, GST aimed to simplify taxation, promote transparency, and improve compliance.

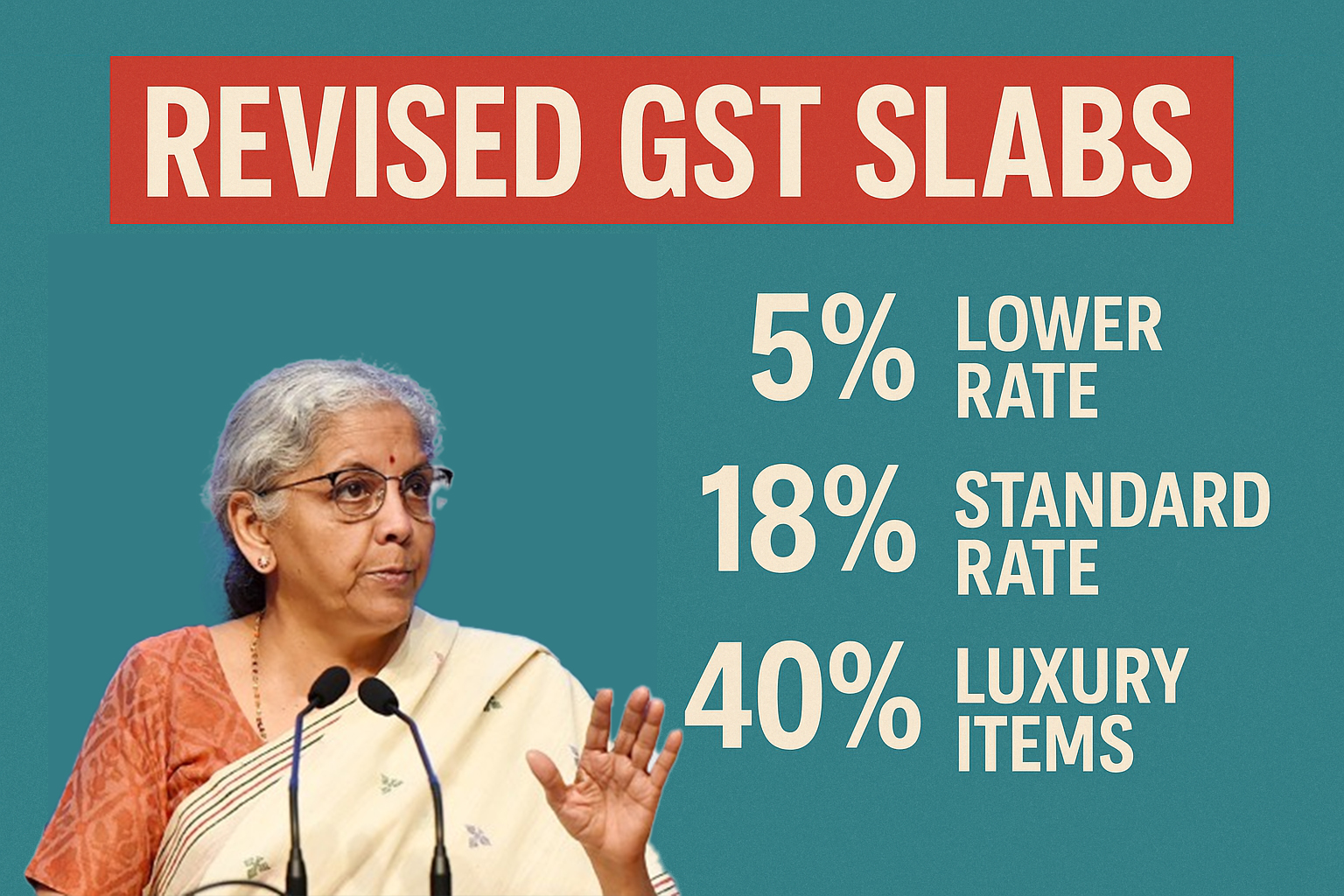

Total Slabs of GST

- Pre-reform: GST operated under four main slabs—5%, 12%, 18%, and 28% (with a 0% for exempted items and additional cess for luxury items).

- Post-reform (effective September 22, 2025):

- 5%: Daily essentials, household items, healthcare, agriculture goods, educational items, etc.

- 18%: Consumer durables (ACs, TVs, dishwashers), automobiles, small cars, some appliances.

- 40%: A new slab for “sin” and luxury goods—tobacco, pan masala, aerated drinks, high-end cars, and carbonated beverages.

- 0% (Exemptions): Life-saving drugs, health/life insurance policies, Indian breads, UHT milk, chena/paneer, maps, notebooks, and some educational tools.

Current Updates about GST

- The GST Council, chaired by Finance Minister Nirmala Sitharaman, officially approved the rationalisation on September 3, 2025, marking India’s most significant GST reform yet.

- The changes are scheduled to be implemented from September 22, 2025, aligning with the Navratri festival.

- The reforms are expected to spur consumption, ease household expenses, and provide relief across sectors—particularly benefiting FMCG, MSMEs, healthcare, and automobile industries.

- The government anticipates a revenue loss of approximately ₹48,000 crore (₹480 billion), which it hopes will be neutralised by increased demand and economic activity.

- The move has already begun influencing prices: Raymond Lifestyle plans to reduce prices of apparel under ₹2,500 in response to the GST cuts—reflecting real-world consumer impact.

Summary Table

| Slab | Description | Examples |

|---|---|---|

| 0% | Fully exempted essentials | Life-saving drugs, health/life insurance, Indian breads, UHT milk, educational items |

| 5% | Everyday household, healthcare, agriculture | Toiletries, packaged foods, bicycles, educational tools, farm equipment |

| 18% | Consumer durables, small vehicles, appliances | TVs, ACs, small cars, motorcycles under 350cc |

| 40% | Luxury and “sin” goods | Tobacco, pan masala, aerated drinks, premium vehicles |